“When the tide goes out…….”

Surprises. By definition, unexpected. Unforeseen.

The first quarter of 2023 had more than its fair share of surprises. The equity rally that started in October last year, hit a series of speed bumps. As the tide of euphoria rolled out, it revealed glaring fault lines within global financial markets.

At Differential, we embrace surprises. It is our stock-in-trade. Surprises, in either direction, serve as a precursor for a revision in future expectations. Successfully navigating this barrage of endless surprises is our investment goal. In this regard, our philosophy leads us to use machine learning and data science in a way that gives us an edge.

Headline asset class returns for the quarter provided a false sense of stability. Market participants faced the full gambit of risk conditions combined with policymaker anxiety – reminiscent of the Global Financial Crisis in 2008/2009 and the Euro Crisis in 2012.

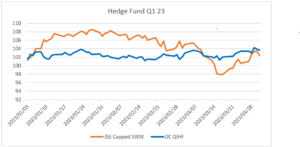

In this context, we had another outstanding quarter – our investment philosophy and approach fired on all cylinders. It is a quirk of markets that doing the right things does not always fully reflect in a quarterly investment performance number. Measured since inception, all our funds remain well ahead of benchmark.

I am proud of how our team navigated a treacherous quarter. It is useful to elaborate on aspects of our approach that are less obvious from a performance-only assessment.

Global Recession

We consistently apply our Macro Economic model, which comes with less bias and variability than a pure humanistic approach. In January 2023, our model was at odds with the prevailing consensus and proved to be an accurate predictor of the Q1 numbers now being reported. The model estimates the transition probability, based on the current state of the economy and the prior trajectory of key metrics.

The current data suggests a world-wide recession. China has not recovered, despite the economy re-opening after Covid. The USA is deteriorating significantly and South Africa is worsening.

In the case of South Africa, we have previously added a judgemental overlay with respect to the impact of load-shedding. Over time, the model steadily captures the load-shedding effect on an indirect basis. As was the case in mid-2020, we will change our economic view as the model changes.

Our disciplined application of the model is a source of comparative advantage. We anticipate that the beneficial impact will become apparent in the fullness of time.

Fragility and Risk Control

Fragility is nebulous concept. In our previous commentary, we highlighted our view that markets were more fragile than most participants were willing to admit. In subsequent meetings with clients, we provided granularity on the trades placed to combat this fragility.

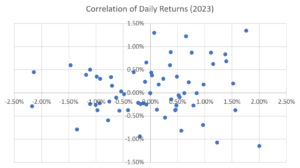

The first three weeks of March provided the vindication for our view and our positioning added significant value. See the scatterplot of our returns. In early March, when the world was faltering, our portfolios stood firm. It is reminiscent of a similar period in March 2020 – the infamous COVID sell-off – when our portfolios performed in much the same way.

Our ability to identify risk-conditions and build our positioning on an ex-ante basis is an additional source of advantage.

Risk-Assets have staged a recovery since the second half of March. We retain a healthy dose of scepticism. Fragility remains endemic and the lack of a rebound in banking stocks, confirms that the crisis is far from over.

Short (er) and Long Duration Plays

Our investment philosophy optimises the interplay between data science and fundamentals. A residual benefit is our ability to cover a wider time spectrum in our equity views.

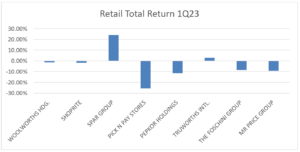

In the first instance, we have had considerable success in shorter duration plays, based on alternative data. In particular, our proprietary data within domestic consumer has added significant value.

In a similar vein, we have utilised incremental data signals to nuance our positioning within Commodity stocks. Over the quarter, we judiciously reduced exposure to PGM’s and Iron Ore shares, while upping the weighting in selected Copper and Gold equities. We are able to respond to incremental signals as they arise, without being beholden to a prior view.

At the same time, we are able to navigate sectors where longer-term fundamental perspectives carry weight. In early March, the US Banking Crisis precipitated a surprising rally in bond yields. Investor response was consistent with a return to the previous market regime of easy money, low interest rates, benign inflation and continuous policy back-stops. Technology stocks led the way as the typical long-duration winners in the equity space.

We do not share the market’s broad-based adoration for Technology shares. We prefer the global luxury sector, which contains many businesses that enjoy the virtuous tailwinds of premiumisation, consumer aspiration and sustained revenue growth. See our article on Ferrari, for an example of a long-duration thesis, with positive near-term prospects

Summary

The prospective market environment is well suited to our approach for selecting equities and identifying disconnects in expectations. Our flexibility in response to incremental data allows us to respond timeously as market events unfold. For all these reasons, we remain positive on our equities in the face of economic headwinds.