Ferrari has been one of our strongest contributors in the hedge fund with the counter up 30% YTD in EUR terms and 50% over the past six months. One of the key reasons this flagged as an opportunity by our models is bearish macro expectations, as well as earnings surprise potential in this environment.

On the face of it, it is probably clear to most investors that the extent of QE, particularly following the Covid crisis, has resulted in massive amounts of liquidity. It should not be a surprise that the wealthy have become far more entrenched and, in our view, this is likely to be sustained. We have also witnessed a substantial increase in the number of extremely wealthy individuals in Asia.

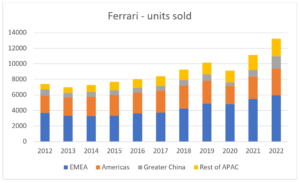

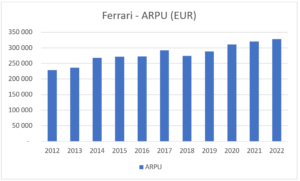

We can see from the above that there has been a steady increase of around 6% compound annual growth rate (CAGR) in volumes. This has been bolstered by impressive growth in other Asia-Pacific countries, notably South Korea. Furthermore, the average revenue per car has risen from about EUR230k to EUR330k over the last decade, at about 4% CAGR.

The combination of being a premium brand and a highly effective manufacturer has allowed Ferrari to increase EBIT margins from 15% to 25% over the last decade.

However, there is a secondary, but perhaps more powerful driver behind Ferrari’s outlook. One of the key investment risks to Ferrari is that it is almost completely a producer of internal combustion engine (ICE) vehicles. Many investors, including ourselves, doubt Ferrari’s ability to successfully move over to electric drive trains. Here – we must admit there are no complicated machine learning models – it is simply our fundamental intuition that a silent Ferrari is probably not going to set hearts racing.

The longer-term risk to the investment case is driven by ICE bans that will come into force in many countries around the world as the globe looks to curb emissions. Therefore, from an ESG perspective Ferrari appears handicapped.

However, there is a bright spark which may potentially re-ignite the engines of appetite for the stock. Over the past few months, the news flow around e-fuels has ramped up significantly, with the EU set to allow ICE vehicles that operate on e-fuels to continue to be sold after 2035.

E-fuels are synthetic fuels that are produced on a net-zero basis, and supposedly will assist in the carbon reduction targets. These include e-Diesel, e-Gasoline and others that are produced by methods that result in carbon capture and thus, the burning of these fuels does not increase the carbon in the atmosphere. There is much heated debate around this issue and it remains to be seen whether these are viable replacements for current conventional fuels like diesel and petrol. Nonetheless, there has been a material positive revision in the outlook for these, culminating in regulatory exemption.

Auto manufacturers like Ferrari consider this as the equivalent of e-cigarettes to a tobacco company. We admit that the stock has likely priced in a substantial amount of this potential good news, however, there is still some potential for upside relative to global equities based on our analysis and expectations of a fragile global economy. As always, our process is data-driven and should the data suggest limited return potential, we do not hesitate to reduce exposure.